WellsTrade does not currently offer portfolio margining. Portfolio margining: Portfolio margining computes real-time margin for stock and options trades based on risk instead of fixed percentages.Price improvement: WellsTrade reports a per-share price improvement of $0.0101 on eligible equity orders and a per contract price improvement of $9.65 on eligible options orders.

Wells Fargo launched mobile banking in 2007, and within 10 years it had more than 14.5 million users. You can access Wells Fargo Online and the bank's mobile app via a secure and simple Wells Fargo banking login. WellsTrade accepts an average of $0.15 in payment for order flow on options orders it does not accept PFOF on marketable stock and ETF orders. Like most major banks, Wells Fargo offers online banking and other services that give customers convenient access to their accounts, online bill payments and financial transactions. Payment for order flow: Some brokers earn money by accepting payments from market makers for directing equity and options orders to them-a practice called payment for order flow (PFOF).Unlike some brokerages, it does not share any portion of that revenue with you. Stock program: WellsTrade earns revenue by loaning stocks in your account for short sales.Depending on interest rates, it may be a good idea to open a Wells Fargo Bank account and move uninvested cash to an interest-earning account or money market fund. Customers are automatically enrolled in cash sweep programs, but the interest earned is just 0.01%. Interest on cash balances: Like many brokerages, WellsTrade earns interest on customer cash balances.Live broker fee is $25 in addition to online fees.Paper trade confirmations or account statements are $20.Check fees are $0 unless overnight delivery is requested, then the fee is $15.Wire fees are $30 domestic, $40 international.Termination fee for IRAs if the account holder is younger than 70 ½ is $95. Inactivity fee is $30 per year for households with balances below $250,000.Margin interest at $10,000 balance is 9.75%.Mutual fund fee for those not on no-transaction-fee list is $35.Fixed-income has a $50 fee per transaction for Treasuries and bonds.

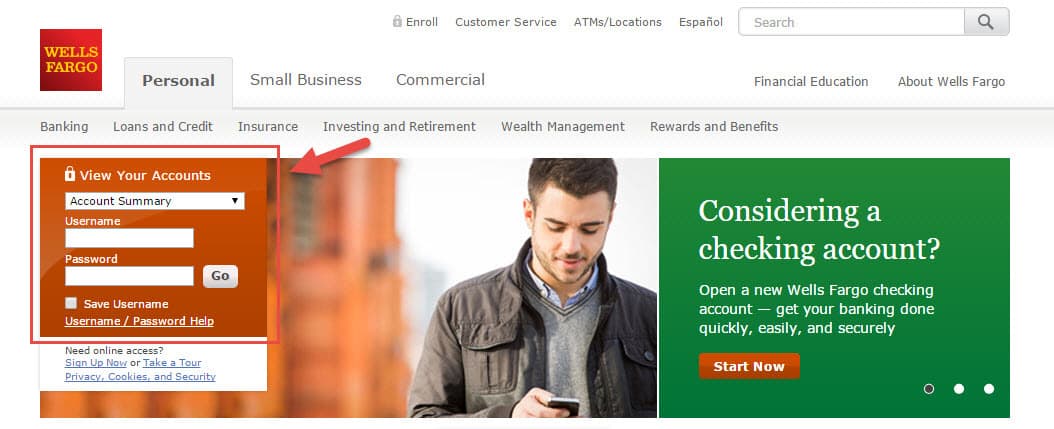

#WELLS FARGO ONLINE ACCESS PLUS#

Cost to open or close any trade of a stock or ETF priced less than $1 per share is the greater of $34.95 or 3.5% of principal.Cost to open or close 1,000 shares is $0. Cost to open or close an order of one share priced at $1 or greater is $0.

0 kommentar(er)

0 kommentar(er)